BayPass all-agency transit pass pilot advances - but omits opportunities to increase ridership

Clipper BayPass - the Bay Area’s successful all-agency transit pass pilot - is taking an important step forward, expanding from the first set of institutional customers - public colleges/universities and affordable housing communities - to employers by the end of this year.

The program’s first phase is showing impressive results - the approximately 50,000 users with the all-agency BayPass show a 35% increase in transit ridership over users that only have a single agency pass, generating over 2 million trips. MTC developed an inspirational video showcasing BayPass outcomes, including happy customers such Thelma Eally, a resident of a senior affordable housing community in Colma, and Ri Bussey, a student at Santa Rosa Junior College who can go to work and school.

Clipper BayPass Phase 2 - expanding to employers and workers

The second phase of the pilot is intended to reach about ten employers around the region, and around 20,000 additional riders over the next two years, and test the opportunity to increase transit ridership further. At this past Monday’s Fare Integration Task Force meeting, transit general managers reviewed and approved the structure of the pilot.

All of the General Managers were in support, with Bob Powers of BART particularly enthusiastic. This is a major turnaround for BART, which prior to the pandemic was leery of fare integration, concerned that it would take away from fare revenue.

However, agencies that already had single-agency pass programs are nervous that they might see less revenue - even though an all-agency pass will appeal to many more customers, and is likely to increase overall ridership. Think about an employer in downtown San Francisco or San Jose: their workers travel in many directions, so they would benefit most from a pass that enables more employees to commute from where they live.

As with the first phase of the BayPass pilot, the next phase will be available to any existing employer and institutional customer as an upgrade to their “Preexisting Institutional Pass”. To alleviate the risk of undercutting existing pass revenue, the pilot has a condition that “Clipper BayPass will not be offered at a price that undercuts the cost of any Preexisting Institutional Pass Product.”

To help bring back employers who allowed their subscriptions to lapse in the depths of the pandemic, the “existing customer” is defined as a subscriber to an institutional program pass program as of January 1, 2020.

Alleviating risk of revenue loss - and leaving out opportunity to increase ridership

But the second phase of the program is missing out on some important opportunities to increase transit ridership.

The agency that is the most concerned about revenue loss is Caltrain - since about a third of Caltrain’s fare revenue has been generated by the GoPass single-agency pass, before the pandemic and still today.

Caltrain’s concern isn’t imaginary, because the revenue model of the BayPass pilot is very different from the GoPass. With the GoPass, employers pay a flat rate per worker for all workers at the site, at a price per employee that is much lower than a retail pass. Caltrain pockets all the revenue, even if a relatively small share of employees use Caltrain.

With the BayPass, MTC will pay agencies based on the amount of trips that employees actually take at a rate equal to a regular adult Clipper Fare. Caltrain estimates that this reimbursement formula would generate much less revenue to the agency.

According to the terms of the pilot, MTC and BART (who are jointly administering the program) will take only up to $1 million to reimburse administration costs. However, the remaining additional revenue will be “will be allocated to transit operators based on each operator’s share of overall Phase 2 ridership.” Because Caltrain’s ridership is lower than BART and Muni, what this would do, in effect, would be to redistribute revenue to larger operators.

The program has a condition not to undercut the pricing for current customers with an institutional pass - but the program would undercut revenue for customers that are new to Caltrain. The deeply problematic solution - avoid new customers.

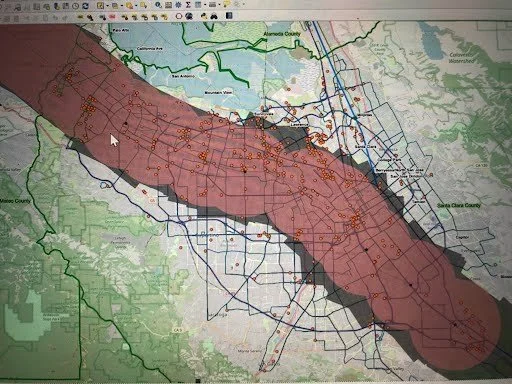

To alleviate risk to Caltrain, the terms of the Phase 2 pilot state that “In San Mateo County and Santa Clara County, Clipper BayPass will only be offered to Preexisting Institutional Pass Product customers of Caltrain’s GoPass Program within three miles of a Caltrain rail station OR VTA’s SmartPass Program outside of three miles of a Caltrain rail station.”

Excluding San Jose service workers

In other words, no employer within three miles of a Caltrain station that isn’t already a GoPass customer is able to participate in the BayPass pilot expansion. This excludes some attractive opportunities to increase transit ridership - for Caltrain and for the South Bay. The three mile “Caltrain exclusion zone” leaves out about three thousand workers at San Jose Mineta Airport which has been one of the flagship customers of VTA’s SmartPass. It also leaves out many workers at hotels near the airport and downtown San Jose which have been notable SmartPass customers. It also leaves out workers at San Jose City Hall.

In recent years starting before the pandemic, Palo Alto’s Transportation Management Association found that a significant number of hotel, retail and restaurant service workers do use Caltrain when they are provided affordable access through the TMA. In 2019, PATMA shifted over 300 downtown service workers away from driving, and their most popular offering was Caltrain access. This result disproved the conventional wisdom that retail and hospitality workers prefer driving and bus travel and have little interest in rail.

Enabling San Jose’s airport, hotel, and other service workers to gain access to Caltrain and BART through the BayPass program would be a strong equity measure for lower-income service workers. It would allow the pilot to test a hypothesis that in San Jose - as in Palo Alto - a notable number of service workers will shift from driving to transit including rail when they have convenient, affordable access.

By selling BayPass only to existing GoPass customers - not VTA SmartPass customers that are new to Caltrain - the pilot program is setting up for a result where Caltrain shows relatively little ridership growth from the program. This will be puzzling to outside observers as Caltrain, with ridership at 30% of pre-pandemic levels, the lowest of any Bay Area agency - has a critical need to regrow ridership.

Caltrain doubles down on single-agency GoPass

Meanwhile, in its fare and ridership regrowth strategies, Caltrain is focusing on expanding use of the single agency GoPass, for example proposing new lower price points to appeal to educational institutions and affordable housing developments.

For the upcoming year this strategy isn’t wrong - the BayPass pilot is limited in size, and it won’t be available to customers that don’t already have an institutional pass. So it is reasonable for Caltrain to assertively pursue new customers.

But, thinking about the perspective of riders and institutional customers, such as employers, educational institutions, or housing developments, instead of agencies, an all-agency pass is of greater value than a single agency pass. With a multi-agency pass, workers, students and residents can use buses, BART, and Caltrain - as opposed to just Caltrain. When approving a new development, cities will of course prefer an all-agency pass than a (paradoxical) decision about whether to offer a local bus pass OR a Caltrain pass OR a transbay bus pass.

But when presenting its fare strategies to its board, Caltrain staff describes the GoPass as though a single agency pass was still the future, rather than the multi-agency passes that make the most sense for customers.

Revenue-sharing: a gnarly math problem that needs to be solved

The question of how to structure the multi-agency BayPass with pricing that will provide value to institutional customers - with a revenue sharing mechanism that will support the budgets of transit service providers - is a gnarly math problem. This first round doesn’t have the math problem fully solved. Given the existential need to regrow ridership, it is critical that MTC and Bay Area transit agencies continue to work together in good faith to work out better solutions.

The nervousness of Caltrain and other agencies with existing programs can be seen in the provision that “Any agency will have the discretion to participate or not participate in any future post-pilot Clipper BayPass program that may be established.” This condition is a clear indication of the weakness of the region’s “Network Management” system, where initiatives to coordinate among the 27 transit agencies are fragile and can unravel at any moment.

Loss aversion is an understandable and common trait. People fear losing what they had in the past, even when this means missing out on opportunities for the future that are different from the past.

The Bay Area transit system is in dire straits. Ridership has slowly recovered past 50% of pre-pandemic levels, and is the lowest of any region in North America. Caltrain’s ridership is around 30% of pre-pandemic levels. Clearly, the region needs to figure out a way of having transit agencies be financially incentivized to promote the BayPass to potential customers, growing the market for all-agency transit passes that will build ridership.

The role of public funding - voter confidence and equity

Ultimately, the region’s best case for passing a regional funding measure will be a more well-used system that has rebuilt ridership. This will require more professional work to refine the revenue-sharing in a way that meets the financial needs of agencies to run service. And it requires stronger governance to ensure that these solutions are stable and not liable to unravel at any time.

Meanwhile, at board and advisory group meetings, other potential BayPass customers are eager for an even broader rollout. The demand for a broader rollout includes some institutional customers such as community colleges that may need financial support to increase ridership.

BayPass program staff say that their goal is to have a program that is “revenue neutral.” However, as the region starts to plan for a 2026 funding measure that will include funding for a more convenient, integrated system, we wonder if it will be helpful to include funding to support passes for low-budget institutions such as community colleges and affordable housing developments - or whether there might be other sources of public funding.

In the coming months, there will be opportunities to speak in support of this second phase of the BayPass pilot, at MTC and transit agencies - and to encourage the additional work needed to improve revenue sharing and governance to achieve a fair and stable program to increase ridership. Sign up for Seamless Bay Area’s mailing list to stay informed.