State funding needed to advance transit transformation

Securing new transit operating funding from the State government was a major focus of the California Transit Transformation Task Force’s (TTTF) December and February meetings. The funding discussion is critical, since California historically underfunds transit compared to other states, and available funding is not enough to meet the state’s goals for ridership, climate, housing, and affordability.

The TTTF is a major effort to transform transit in California. The state legislature convened the Task Force in 2023 with a broad mandate to study and make recommendations about policies and practices to grow transit ridership statewide. These include benchmarks for service levels, funding recommendations, governance reforms, land use, transit priority, pricing policies, workforce recruitment and retention, and more.

Before November of this year, the Task Force will send a final report with key findings and policy recommendations to the State Legislature.

Where does transit funding come from and how does CA match up to other States?

California transit agencies received approximately $12.5 billion in transit operations and capital funding in Fiscal Year 2022-23.

It's important to note that most of the federal funding can only be used on capital projects and that local and state capital funding are often used to match federal funding requirements.

Source: Transit Transformation Task Force Meeting #8, Staff Report on Options for Additional Funding.

Of the $3.8 billion (31%) of transit agency funding. Most of this is dispersed from three main sources:

~$1.2 billion: Local Transportation Fund (LTF)

~$1.1 billion: State Transit Assistance and State of Good Repair (STA)

~$0.7 billion: Transit and Intercity Rail Capital Program (TIRCP)

Funding is generated from three main sources:

Transportation Development Act (TDA) – from sales taxes and diesel taxes

Senate Bill 1 (SB1) – from gas taxes, vehicle registration fees

Greenhouse Gas Reduction Fund (GGRF) – from Cap-and-Trade Auction Fees

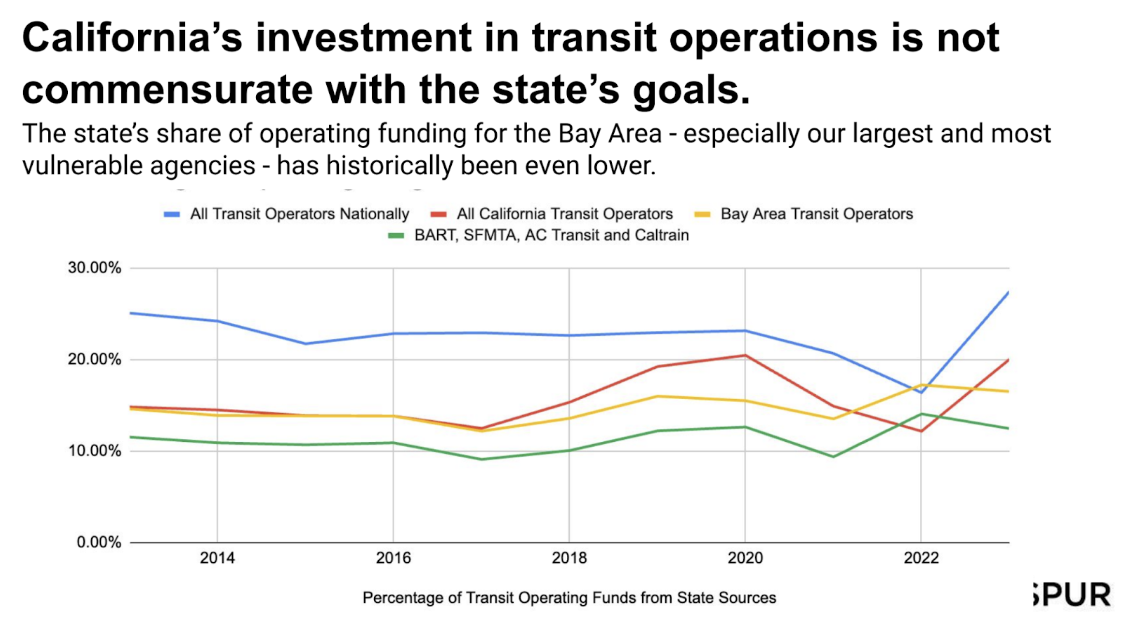

California relatively underfunds transit compared to other states with largest transit systems. The underinvestment is even more striking for operating funding, according to analysis conducted by SPUR using data from the National Transit Database (see chart below).

Task Force members agree: new revenue sources needed from the State

"The most important thing to come out of this Task Force is a very strong statement that the State must invest more money in transit, but in particular, transit operations so we have more service levels,” Alix Bockelman, Chief Deputy Executive Director at the Metropolitan Transportation Commission (MTC) said.

Bockelman stated that new funding resources need to be bold and make transformational change. At the very least, she wants to see a 50% increase in state funding for transit operations. In other states with high transit ridership, 40-50% of transit operations funding comes from the state government. She urged the Task Force to learn from what other states are doing to address their transit fiscal cliffs.

Bockelman was not alone on this point, with most Task Force members agreeing that the State needs to step up and enact new transit revenue generating policies. Most conversation revolved around road user charges to replace the gas tax, road congestion pricing, payroll tax, corporate tax, income tax, and other sources.

California won't be able to transform transit without new revenue sources, said Seamus Murphy, Executive Director of SF Bay Water Emergency Transportation Authority (commonly known as SF Bay Ferry). As such, the top priority for this Task Force should be identifying and recommending new revenue sources.

"The State needs to be a more robust partner,” said Kome Ajise, Executive Director of the Southern California Association of Governments. “I think that's the essence of this conversation: what is the State's role and there couldn't be any more important role than to stand up on the funding side.”

There also needs to be clarity for what is the state's responsibility in this funding model, Ajise continued, noting that regions are already doing what they can in terms of funding.

Ian Griffiths, current Seamless Bay Area Board Member and former Policy Director, said in tandem with new sources of funding, the Task Force should also recommend an efficient review of current operations. He says this would be a prudent political strategy to show they are being as efficient as possible with existing resources.

Multiple Funding Sources

Road User Charge and Congestion Pricing

Michael Pimentel of the California Transit Association also mentioned that by 2035, $300 million in annual State Transit Assistance (STA) funding will be lost due to the transition to electric vehicles and increasing fuel efficiency. Given this decline, he says a road user charge is important to recuperate this funding.

Kari Watkins of University of California at Davis also agreed with this point, saying funding sources have to be tied to things like a road user charge so that we can meet the dual goals of reducing greenhouse gas emissions and so people have good options outside of driving.

"There is a lot of transportation money in the state. It's really a question of how we are using that money,” Watkins said. “Today we both widen an interstate and build a transit system parallel to that and then we're surprised when people are not on transit. We know that if we keep spending money in those ways people are just going to keep driving more and more and more. We have to go back to this basic principle of we want to be inducing travel on transit, not on the roadway system. Any money way we can achieve both of those at the same time should be the very first priority”

Outside of New York, there are not many examples of road pricing in the U.S, Watkins noted. However, international examples like London or Stockholm illustrate good case studies for how transformational changes can be achieved via massive surges in new transit funding.

Juan Matute, Deputy Director of the UCLA Institute of Transportation Studies, agreed with Watkins that roadway pricing is not discussed enough. He noted that because they are not discussed often, people often confuse a flat road user charge with that of a managed lane/congestion pricing system. The strategy of implementing a flat road user charge is very different from that of a system of managed lanes.

Managed lanes work well to incentivize lower traffic congestion, create greater roadway operating efficiency through price signals, and generate revenues. He says this is a value creation because this allows people to use their money to buy back time. A flat road user charge, on the other hand, does not necessarily create operations benefits of a less congested roadway environment, but is a value redistribution from road users to a government agency to be redistributed elsewhere.

Kate Miller, Executive Director of the Napa Valley Transportation Authority, said that we need to be looking at road user charges, congestion pricing, and tolling, which have all proven to influence mode shift.

Griffiths agreed that California should be looking at a road user charge to replace lost gas tax revenues from electric vehicle users. The longer we wait, the harder it will be to implement a road user charge, he added, as more and more people transition to electric vehicles.

He said that a potential road user charge should not be levied on gas cars as they already pay when purchasing fuel. He pointed to New Zealand as a case study.

New payroll, income, or corporate taxes - and more

Griffiths also suggested that California should be looking at other states and how they are raising revenues through payroll, income, and corporate taxes. In New Jersey, for example, the state legislature passed a 2.5% corporate tax on companies earning more than $10 million annually till the law sunsets in 2028. This is expected to generate $800 million in 2024 and was a key to addressing New Jersey Transit's looming fiscal cliff.

Eli Lipmen of Move Los Angeles agreed with Task Member Griffiths, arguing that California should be looking at increasing corporate tax rates, especially if they are going to have a tax cut at the federal level with the new federal administration.

Bockelman is particularly interested in new payroll taxes, vehicle registration fee surcharges, and vehicle value tax (with exemptions for lower value vehicles).

In Paris, for example, payroll taxes fund 48% of the city's transit operating budget, according to Bockelman. She notes that dense areas with a lot of transit are often job centers with a lot of high-paying jobs, but that it would be hard to implement payroll taxes locally or at the state-level without opposition.

Laurel Paget-Seekins, Senior Policy Advocate for Transportation Justice at Public Advocates, also commented that Oregon has a 0.001% payroll tax on employees in TriMet and LTD transit districts to fund these systems. In 2024, this raised TriMet approximately $510 million, a significant portion of their overall budget.

Carl Sedoryk, CEO of the Monterey-Salinas Transit District, suggested a state tourism fee to help generate transit funding. He said that people will always want to visit California, which currently gets 20 million annual visitors, and that we should be getting some more revenue from those visitors.

Griffiths pointed out that income taxes are generally the most common sources of revenue in countries that fully fund public transit. He pointed out that the state of California is uniquely positioned to levy income taxes (localities do not have this authority) and that these should generate revenue in a progressive manner, with high-income earners paying more.

Expanding existing revenue sources

Michael Pimentel noted more funding for transit operations and capital can come from Cap and Trade reauthorization, where the State Legislature will be looking at changing the formula funding.

Currently, 40% of funding goes directly to transit projects – 5% of these funds are set aside for Low-Carbon Transit Operations Program (LCTOP) and 10% for the Transit and Intercity Rail Capital Program, and 25% for the California High-Speed Rail Project.

Sharon Cooney, CEO of the San Diego Metropolitan Transit System said the Task Force should ask for a doubling of funds from the Transportation Development Act (TDA), which allows each county to establish a quarter-cent sales tax to finance public and active transportation projects.

Jaun Matute said that the state and task force should look into new legislation to enable development above subways, regional rail, light rail, and bus rapid transit stations. He said transit agencies would generate orders of magnitude more value with air rights, such as possible additional density bonuses, and transfer of development rights to nearby property owners.

Kate Miller also added that the State needs to step up to create policies and programs that incentivize affordable housing construction near transit. Opportunities to generate revenues from commercial and mixed use development.

Other revenue saving measures

Both Rashidi Barnes, CEO of Eastern Contra Costa Transit Authority, and Michael Pimentel noted ballooning health insurance costs and underfunded mandates like the state's 2040 mandate for transit agencies to fully transition to zero emission buses (ZEB). Barnes said the State can help reduce the financial costs transit agencies are dealing with by working with state agencies and pushing them to reduce these financial burdens.

A zero-emission battery electric AC Transit bus. Source: MTC and ABAG.

Pimentel added that sales and use tax exemptions for zero-emissions buses will expire in 2026 and needs to be extended. According to Pimentel, electric buses are often two to three times more expensive, costing between $30-50k each, and the expiration of these sales tax exemptions will be costly for transit agencies. He also noted that the sales tax exemptions should be expanded to more vehicles like ferries and trains.

Pimentel also brought up the failure of Prop 5, which would have reduced the voter threshold for local ballot measures, including transit projects.

Following requests from Task Force members for more data, CalSTA staff compiled options for additional funding sources which were presented at the February meeting. Ian Griffiths noted that the staff report lacked mentions for opportunities for cost efficiencies – such as centralizing administrative functions across transit agencies either at a regional level or at a state level – despite this being talked about at the task force.

He also stated that other cost efficiency strategies were absent from this report, including practices of service contracting or franchising, as are used in other parts of the world. He noted that international models of transit service procurement show how this can be done with high labor standards and union labor.

The funding strategies discussed by the Task Force will require building political will, which is all the more reason for the Task Force to make strong recommendations that can deliver the funding needed for public transportation to achieve the state’s goals.

Next Steps

The next TTTF Meeting in April is expected to continue conversations about new revenue sources. We will blog the highlights from that meeting.

You can access the slides and video recordings from both the December and Feburary meetings here. To learn more about the discussion and topics at the TTTF, read our recaps of the 1st, 2nd, 3rd, 4th, 5th, and 6th meetings.